Over-the-counter Otc Inventory Market Definition The Motley Idiot

OTC markets have less stringent itemizing requirements and disclosure guidelines. Companies on OTC markets don’t want to satisfy the minimum standards for shares, market capitalization, or monetary disclosure that the most important exchanges mandate. While this implies OTC markets supply entry to rising firms, traders take on extra risk.

Investors should be ready to carry OTC positions longer and threat greater losses, regardless of the potential for outsized features. FINRA additionally publishes mixture details about OTC trading exercise for each exchange-listed shares and OTC equities, each for trades occurring by way of ATSs and out of doors of ATSs. Additionally, FINRA publishes quite a lot of information about OTC equity occasions, corresponding to corporate actions, trading halts and UPC advisory notifications, among other things. Most common stocks with actual potential are priced over $15 per share and are listed on the NYSE or Nasdaq. Stocks priced below $5, which trade over-the-counter, could have murkier monetary outlooks and are usually speculative and very risky. OTC shares are generally identified as penny shares as a end result of they often commerce for lower than $5 per share.

How Do You Commerce On Otc Markets?

Interactive Brokers, TradeStation, and Zacks Trade are among people who do. ✝ To verify the rates and terms you might qualify for, SoFi conducts a gentle credit score pull that won’t have an result on your credit rating. Get inventory suggestions, portfolio guidance https://www.xcritical.com/, and more from The Motley Fool’s premium companies. Although it’s straightforward to buy OTC shares, the more durable query to reply is whether or not or not you ought to buy OTC shares.

The OTC Markets Group operates regulated markets for buying and selling over 12,000 U.S. and worldwide securities that aren’t listed on indices and exchanges like the Dow Jones or Nasdaq. With less transparency and oversight, OTC corporations require in depth analysis. Analyze the company’s enterprise mannequin, leadership group, financials, industry outlook, and risks to discover out if the inventory price appears fairly valued earlier than buying in. You want to know, as completely as potential, what is driving the company’s inventory value. Our InvestingPro platform offers buyers a approach to display screen and analyze securities across all tiers of the OTC markets.

Tens of hundreds of small and micro-capitalization corporations are traded over-the-counter around the globe. Any estimates based on previous performance do not a guarantee future efficiency, and prior to making any funding you must focus on your specific investment

They additionally require corporations to file financial disclosures and different paperwork before they can start itemizing. On the optimistic side, OTC markets supply opportunities for larger returns since the companies listed on these exchanges are sometimes smaller, high-growth firms. The OTCQB and OTCQX markets have much less stringent listing necessities than main exchanges, so companies at an earlier level of development can listing their shares. For investors, this means getting in on the ground flooring of potential high-growth shares. OTC markets provide alternatives for emerging firms and microcap stocks that don’t but meet the listing requirements of major exchanges.

Seeking the steering of a qualified monetary skilled also can assist you to navigate the complexities of these markets. The overseas trade (forex) market is the biggest and most liquid financial market globally. Unlike stocks or commodities, forex trading occurs solely over-the-counter (OTC). This decentralized nature allows for larger flexibility in transaction sizes. However, it also exposes traders to counterparty risk, as transactions depend on the other celebration’s creditworthiness.

Dangers Of Otc Stocks

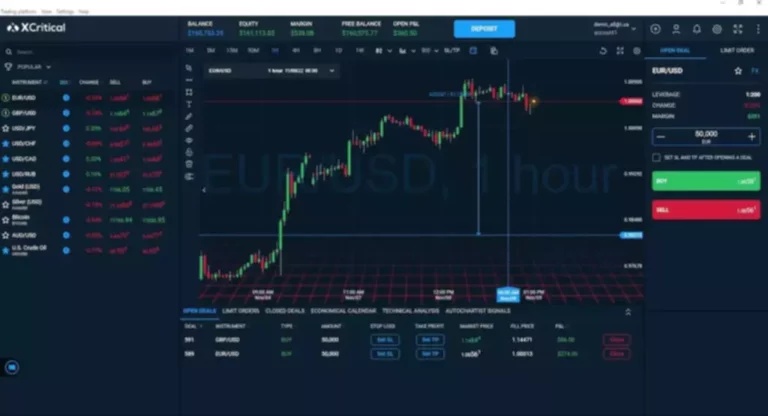

To qualify for this tier, firms must meet larger financial requirements, be current in their reporting, and bear an annual qualification evaluate. The OTCQX is the premier market for established, investor-focused U.S. and international corporations. On OTC markets, broker-dealers negotiate instantly with each other to match consumers and sellers. Investors can discover distinctive alternatives not obtainable on mainstream exchanges, similar to complicated transactions, odd tons, block trades, and particular terms.

In most cases, they’re trading OTC because they don’t meet the stringent itemizing requirements of the major inventory exchanges. Investors are familiar with buying and selling on an change such as the NYSE or Nasdaq, with common financial reviews and relatively liquid shares that may be purchased and offered. On an exchange, market makers – that is, big buying and selling companies – help hold the liquidity high in order that traders and traders can move out and in of shares. Exchanges also have certain requirements (financial, for example) that an organization should meet to keep its stock listed on the exchange. OTC markets do current extra risks to investors compared to major exchanges.

Many respected mainstream brokers provide OTC trading, and you can find one of the best OTC dealer for your needs proper right here on the investing.com web site. For companies not listed on major exchanges like the NYSE or Dow Jones, OTC markets provide a method to go public and raise capital. Investors should exercise warning, especially with thinly traded penny stocks, as there’s higher potential for fraud and manipulation. By distinction, an OTC fairness issuer may or will not be required to file these reports. Some OTC fairness issuers do file common reports with the SEC like listed firms, and a few non-SEC reporting OTC fairness issuers might make certain monetary data publicly obtainable by way of other avenues.

Online Investments

These issues provided apparent openings for much less scrupulous market participants. Let’s say a small firm wants to promote its stock however doesn’t meet the prerequisites of an exchange, such as reaching a minimum share price or having a certain number of shareholders. NerdWallet, Inc. is an independent writer and comparison service, not an investment advisor. Its articles, interactive tools and other content material are provided to you at no cost, as self-help tools and for informational functions only. NerdWallet doesn’t and cannot guarantee the accuracy or applicability of any info in regard to your individual circumstances. Examples are hypothetical, and we encourage you to hunt customized recommendation from qualified professionals regarding specific investment issues.

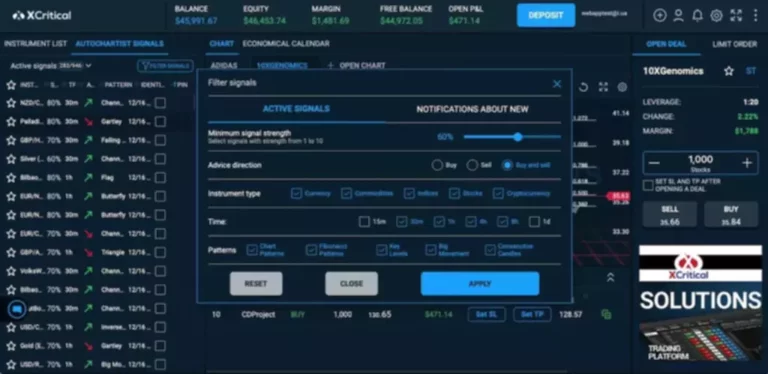

Traders can place purchase and promote orders via the Over-the-Counter Bulletin Board (OTCBB), an electronic service supplied by the Financial Industry Regulatory Authority (FINRA). There is also the OTC Markets Group—the largest operator of over-the-counter trading—which has eclipsed the OTCBB. Pink Sheets is one other listing service for OTC penny stocks that usually commerce under $5 per share. Investors ought to train warning when contemplating these very speculative securities. The OTC Markets Group offers value transparency by publishing one of the best bid and ask costs from market makers on their website and buying and selling platforms.

Fewer Regulatory Protections

As with any funding determination, it’s essential to fully think about the pros and cons of investing in unlisted securities. That’s why it’s nonetheless important to analysis the shares and firms as a lot as potential, completely vetting the available data. That mentioned, the OTC market is also residence to many American Depository Receipts (ADRs), which let investors buy shares of international firms.

You can put money into shares, exchange-traded funds (ETFs), mutual funds, different funds, and more. SoFi doesn’t charge commissions, however different fees apply (full charge disclosure here). OTCQX is the first and highest tier, and is reserved for corporations that present essentially the most element to OTC Markets Group for listing. Companies listed right here should be up-to-date with regard to regulatory disclosure requirements and maintain correct financial records.

There are more than 12,000 securities traded on the OTC market, together with stocks, exchange-traded funds (ETFs), bonds, commodities and derivatives. Trading foreign shares directly on their local exchanges can be logistically difficult and expensive for individual buyers. Since the exchanges take in a lot of the legitimate funding capital, stocks listed on them have far greater liquidity. OTC securities, in the meantime, typically have very low liquidity, which suggests just some trades can change their prices quick, resulting in important volatility. This has made the OTC markets a breeding ground for pump-and-dump schemes and different frauds that have long stored the enforcement division of the united states

This could be accomplished by searching for the OTC stock on the platform and placing an order. Investors may must know the specific stock ticker they’re on the lookout for, nonetheless, so there may be a little bit of initial homework concerned. As mentioned, an OTC stock is one which trades exterior of a standard public inventory change. As such, so as to grasp OTC inventory buying and selling and how it works, it helps to have a clear understanding of public stock exchanges. Stocks and bonds that trade on the OTC market are usually from smaller firms that don’t meet the necessities to be listed on a major change.

Premium Investing Services

An over-the-counter spinoff is any spinoff safety traded in the OTC market. A by-product is a financial safety whose worth is set by an underlying asset, similar to a inventory or a commodity. An proprietor of a derivative does not personal the underlying asset, in derivatives such as commodity futures, it’s attainable to take delivery of the bodily asset after the derivative contract expires. It is not over the counter securities inconceivable for a corporation that trades OTC to make the leap to a serious trade. But, as famous above, there are a number of steps it must take before they’ll record. Read on to find out more about the difference between these two markets, and the way companies can transfer from being traded over-the-counter to a standard change.