Explained simply for beginners, it’s a method to maximize the potential profitability of your cryptocurrency by placing it to work as a monetary tool. Learn what makes decentralized finance (DeFi) apps work and the way they examine to traditional defi yield farming financial merchandise. Moreover, your potential yield farming earnings are highly depending on the value of the protocol token you receive as your yield farming reward.

Harvest Finance is a yield farming aggregator that optimizes users’ returns by mechanically reallocating their funds across varied DeFi protocols. It supports a broad range of stablecoin pairs and makes use of subtle methods to farm essentially the most worthwhile yields for its users. Harvest Finance’s native token, FARM, plays a crucial role in its ecosystem and permits community governance and participation. Users can stake their FARM tokens within the Harvest Finance governance pool to have a say in important decisions concerning the platform’s future developments, protocol upgrades, and fee constructions. Protocols that have followed the liquidity mining model embody a variety of functions, from decentralized exchanges to money markets, yield aggregators, and past.

A decentralized change (DEX) is a sort of exchange that makes a speciality of peer-to-peer transactions of cryptocurrencies and digital belongings. Unlike centralized exchanges (CEXs), DEXs don’t require a trusted third party, or intermediary, to facilitate the trade of cryptoassets. If you presumably can stomach the chance, yield farming can be an thrilling way to earn yield on your crypto. However, you must conduct your own analysis and never invest more than you possibly can afford to lose. Finally, the yield you obtain at present may not be the yield you obtain tomorrow. High yields are inclined to compress as extra yield farmers begin to move funds into a high-yielding farm, affecting your returns.

Benefits Of Yield Farming

When choosing a Yield Farming platform, components to consider embody the platform’s reputation, security measures, audit reviews, tokenomics, APY (Annual Percentage Yield), fees, and the tokens available for farming. Yield farming first appeared within the crypto panorama around 2020, with the emergence of platforms like Compound and Yearn Finance. Since then, it’s grown exponentially, providing users with new alternatives to earn passive revenue from their crypto investments.

Cream Finance operates on the precept of decentralization, which means that it doesn’t rely on a centralized authority to handle transactions or control person funds. Instead, it makes use of sensible contracts and blockchain expertise to automate lending and borrowing processes, guaranteeing transparency and security. At its core, yield farming involves locking up or lending out crypto belongings by way of Top DeFi Yield Farming Platforms protocols to earn rewards. These rewards can are available numerous varieties – from curiosity payments to governance tokens or different tokens that unlock entry to certain providers at a discounted price. The greater the amount of crypto you lend, the higher the reward you can expect to earn. Yield farming essentially allows crypto customers to place their assets to work, producing passive revenue within the type of additional tokens.

This allows users to earn passive income on their holdings, just like incomes curiosity on a conventional savings account. The yield farming opportunities on PancakeSwap could be extremely worthwhile, but additionally they come with risks. The worth of the LP tokens you stake can fluctuate, and there is all the time a chance of impermanent loss.

The platform supports all kinds of cryptocurrencies, giving users the pliability to choose the belongings they wish to invest in or use for yield farming. This makes it convenient for users who’ve diverse crypto portfolios or favor specific digital currencies. YouHodler also presents aggressive rates of interest on deposited funds, allowing customers to earn additional income on their crypto holdings.

There are different types of tokens available out there that have their own protocols and platform wants. There are different sorts of tokens available out there which have their very own protocols and platform needs. Given that every one three are free-floating, the revenue (or loss) potential for participants is important.

Yield Farming In Decentralized Finance

When a strategy stops working, the yield farmers will move their funds between protocols or swap coins to those who can generate extra yield. Users who participate in yield farming on Lucky Block also have the chance to enter the lottery. This provides an element of pleasure and chance to the platform, as customers have the potential to win even more tokens or valuable prizes.

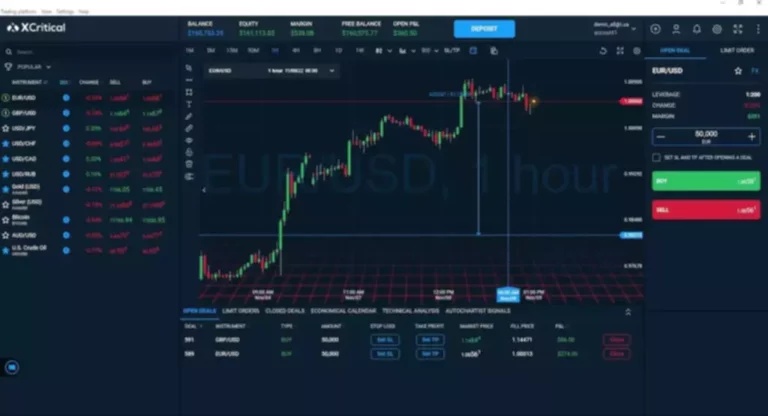

Yield farming is putting cryptocurrency assets in a liquidity pool or other decentralized finance (DeFi) platform to earn a higher return. It was once the most significant growth driver of the fledgling DeFi sector, nevertheless https://www.xcritical.com/ it misplaced most of its 2020 hype after the collapse of the TerraUSD stablecoin in May 2022. To further boost the liquidity incentivization and fair distribution of tokens enabled by yield farming, good contract developers can leverage further infrastructure.

This cycle is designed to propel a protocol by continually absorbing liquidity, as users and liquidity providers alike naturally gravitate toward applications with the bottom slippage and highest yield. It’s worth noting that this impact works equally within the inverse scenario—if much less and fewer liquidity is available in a protocol, the fewer customers it attracts, which in flip generates even much less liquidity, and so on. Yield farming incentives may also be used to siphon liquidity from other protocols, where if sufficient liquidity migrates over, the liquidity network effect moves from the old protocol to the new.

How Does Yield Farming Work?

For instance, suppose you desire a new financial savings account that provides the highest annualized percentage yield. You would compare the accounts and see which will provide you with the best return in your money throughout different products. The returns of various yield farming strategies may be expressed in the identical way. However, when you think many savings accounts might have a zero.1% APY, that means you don’t get lots on your investment, yield farming can boast as a lot as 100 percent APY. One of the most nicely liked areas in cryptocurrency right now is decentralized finance (DeFi). Entrepreneurs within the crypto market will recreate conventional monetary tools inside a decentralized environment, exterior of the management of any firm or authorities.

Powered by decentralized oracle networks, Chainlink Price Feeds and Chainlink Automation can be utilized in a large number of ways in yield farming. Unlike working as a liquidity provider on a decentralized trade, stake farms solely need customers to deposit a single asset to find a way to generate passive revenue. Yield farming can appeal to extra individuals to DeFi protocols and improve consumer adoption, despite nonetheless being an immature technique. It is but to become an efficient market, which means there are numerous alternatives to discover a high return fee in comparison with traditional finance. It is a fancy strategy, so whereas we have offered an summary here, you will want to take a look at more detailed guides earlier than venturing into the yield farming world. An investor will strategy a DeFi platform like Compound, accumulating crypto assets, and lending them to borrowers, paying again curiosity on the loan to the investor.

A Beginner’s Information To Defi Yield Farming

In yield farming, the stake farming method concentrates on safeguarding the deposits somewhat than providing buying and selling freedom. When compared to liquidity pool farms, stake farms may provide users with a extra environment friendly experience. Another yield-generation strategy that has traders fascinated is stake farming. The methodology entails a person funding a smart contract with cryptocurrency that has been configured to offer a staking pool.

Impermanent loss occurs when the worth of the tokens in the liquidity pool modifications in comparison with if you initially deposited them, resulting in a possible loss when you withdraw your tokens. Additionally, as with all decentralized exchange, there is a risk of good contract vulnerabilities and hacking attempts. While PancakeSwap has carried out safety measures, no platform is totally resistant to assaults. Be prudent with your investments and never put more on the road than you’re keen to part with. These are only a few examples of the top-yield farming platforms expected to dominate the market in 2024. It’s important to do your personal analysis and think about elements similar to platform safety, neighborhood help, and governance buildings before selecting a platform for yield farming.

Compound distributed COMP tokens to its users, granting them governance rights to affect protocol actions and enhance engagement. Within a single day of trading, Compound turned the highest DeFi protocol, reaching practically $500 million in staked worth. Activity as a end result of Compound’s token distribution remained relatively sturdy with various spikes in exercise until the top of 2021. Yield farming is a high-risk investment technique during which the investor provides liquidity, stakes, lends, or borrows cryptocurrency belongings on a DeFi platform to earn a higher return. It stays to be seen how yield farming will change and evolve into the future, and whether current forms of yield farming will maintain long-term progress.

Decentralized finance (DeFi) platforms incentivize liquidity providers with LP tokens, representing their deposits in the pool. These tokens enable suppliers to withdraw their deposits together with accrued interest from buying and selling fees at any time. The steps will contain lending, borrowing, supplying capital to liquidity swimming pools, or staking LP tokens. Instead of just incomes rewards passively, gamers can actively have interaction in battles and quests inside the sport to earn further rewards.